[Notices]

○Money Lending Desk Opened

Aiming to resolve the multiple debt problem, the Amended Money Lending Business Act which “lowers the maximum interest rate” and “introduces total quantity regulations to prevent excess borrowing and excess lending” etc. was passed unanimously in December, 2006.

This act came into force in stages over a 3.5 year period, and was completely in force on June 18 this year.

After it was completely in force, the “Amended Money Lending Business Act Follow-up Team” was established on June 22, in order to facilitate enforcement of the Amended Money Lending Business Act, and to study prompt and appropriate responses as needed.

This “Follow-up team” is the first pillar in measures to promote “thorough awareness of the system concerning the Amended Money Lending Business Act.” It is working to make this system widely known, including by expanding and extending to the end of August the “Borrowers, Beware” Campaign, which was scheduled to end at the end of June this year.

As part of these initiatives, the FSA established the “Money Lending Consultation Desk” on July 23, as a contact point for consultations, etc. regarding the Amended Money Lending Business Act. The “Money Lending Consultation Desk” handles inquiries about the Amended Money Lending Business Act, like

- Interest rates fell due to the amendment of the Money Lending Business Act, but does this apply to borrowings contracted on or before June 18?

- I was asked to submit my annual income certificate. If I don’t submit it, then will I be unable to get loans?

and consultations about borrowing from money lending businesses.

If you have questions, need consultation, etc., please contact the Money Lending Consultation Desk (below).

In cooperation with related institutions etc., the FSA will continue its work to enhance and improve consultations, to make the system thoroughly known, and to understand the actual status.

| Name | : Money Lending Consultation Desk |

| Began | : July 26, 2010 |

| Period open | : Until December 28, 2010 |

| Hours | : Weekdays 10:00 - 18:00 |

| Tel | : 0570-001127 *From an IP tel or PHS, dial 03-3506-7229. |

| Service | : Consultation etc. on Amended Money Lending Business Act |

*For details, please go to the FSA’s web site and access Money Lending Consultation Desk opened (July 23, 2010) at the “Press Releases” section. (Available in Japanese only)

○Is That Money-Making Scheme Safe?

Beware of fraudulent investment solicitation!

There have been frequent cases of fraudulent investment solicitation related to unlisted stocks and investment funds.

Please watch out for such fraudulent investment solicitation.

Warning about transactions related to “unlisted stocks” and “privately placed bonds”

Ο Generally speaking, it is inconceivable that a broad range of investors will be solicited to make transactions related to unlisted stocks and privately placed bonds.

⇒ As solicitation for such investments may be an illegal act, investors should take care never to be involved in such transactions.

Warnings about “investment funds”

Ο Under law, only business operators registered with the FSA (or a Local Finance Bureau) are permitted to solicit a broad range of investors to invest in investment funds.

⇒ As solicitation made by an unregistered business operator may be an illegal act, investors should take care never to be involved in such cases.

It is important to make a decision as to whether or not to actually make an investment based on an adequate understanding of the contents of the transaction. If there are any suspicious points, we advise you to act cautiously, such as by refraining from making the transaction.

Ο On the FSA web site, you can obtain more detailed information and check whether the business operator soliciting you is registered with the FSA (or a Local Finance Bureau).

Ο Please note that even if business operators are registered with the FSA (or a Local Finance Bureau):

- their creditworthiness is not assured; and

- they are prohibited from making solicitation by suggesting the principal is guaranteed or the transaction is sure to bring profits, for example.

When you have detected suspicious solicitation activity, be sure to contact the FSA’s Counseling Office for Financial Services Users.

Ο Counseling Office for Financial Services Users (Phone calls are accepted from 10 a.m. to 4 p.m. on weekdays.

Phone No. (Navi Dial Service number): 0570-016811

*Phone calls from an IP phone or a PHS phone are to be made to 03-5251-6811.

FAX: 03-3506-6699

* For further details, please refer to the following FSA websites (available only in Japanese)

- Watch Out for Suspicious Investment Solicitation, etc.

- List of licensed (registered) Financial Institutions

○Protecting the markets with information received from the public!

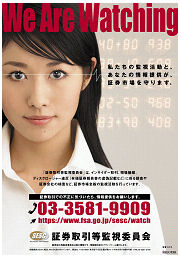

The mission of the Securities and Exchange Surveillance Commission (SESC) is to ensure the fairness and transparency of Japan’s markets and to protect investors, through exerting its authority of market surveillance, inspections of securities companies, administrative monetary penalties investigations, disclosure documents inspections and investigations of criminal cases.

The SESC receives a wide range of information from the general public via phone, mail, fax and the internet, relating to suspected misconducts in the market such as those below. Information received is effectively used as reference material in its investigations, inspections and other activities. During business year 2009, the SESC received 7,118 items of information.

« Information on specific stocks »

|

Poster calling on the general public to provide information |

« Information on financial instruments business operators, etc. »

- Wrongful acts by securities companies, foreign exchange margin (FX) traders, management firms, investment advisories/agencies, etc. (inadequate explanation of risks, system-related problems, etc.)

- Problems related to business management systems or financial conditions (risk management, customer asset segregation, calculation of capital adequacy ratio, etc.)

« Other information »

- Information on suspicious financial instruments, suspicious funds (fraudulent fund-raising schemes, etc.) or on unregistered business operators

- Information on market participants who are likely to impair the fairness of markets (so-called speculator groups, etc.)

If you have any information like that described above, please be sure to submit it to the SESC. In addition to information on shares, the SESC also accepts a wide range of information on derivatives, bonds and other financial instruments. (Please note that the SESC does not accept individual requests for dispute resolution and inspections.)

To submit information via the internet, please access the Securities Watch & Report Portal on the SESC website. (Available in Japanese only)

♦SESC Securities Watch & Report Portal

Central Government Office Building No.7, 3-2-1 Kasumigaseki, Chiyoda-ku, Tokyo, JAPAN 100-8922

Direct line: +81 (3) 3581-9909

Fax: +81 (3) 5251-2136

https://www.fsa.go.jp/sesc/watch/![]()

Site Map

- Press Releases & Public RelationsPage list Open

- Press Releases

- Press Conferences

- Official Statements

- FSA Weekly Review & ACCESS FSA

- Speeches

- For Financial Users

- Others

- Archives

- Laws & RegulationsPage list Open

- Name of Laws and Regulations(PDF)

- Recent Changes (Legislation, Ordinances, Guidelines)

- Guidelines

- Financial Instruments and Exchange Act

- Financial Monitoring Policy

- Public Comment

- No-Action Letter System

- Procedures concerning Foreign Account Management Institutions