Japanese![]()

First published: November 6, 2020

Last updated: January 12, 2021

Financial Services Agency

Local Finance Bureaus

Promoting the Use of English and Establishing a Single Point of Contact for Foreign Asset Management Firms

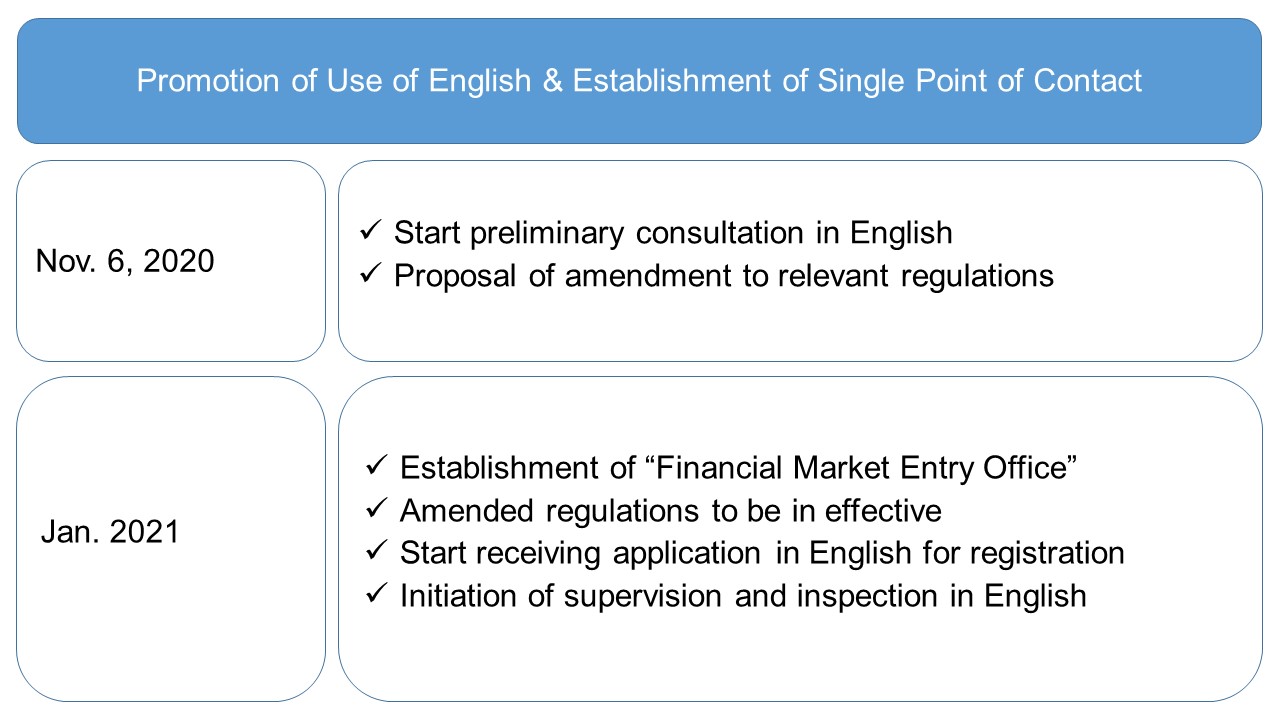

Prime Minister SUGA Yoshihide stressed in his first policy speech to the Diet in October that the Japanese government will pursue a range of initiatives for a global financial center in Asia and the world. Strengthening Japan’s functions as a global financial center will help to make global financial markets more resilient against crises such as natural disasters through geographical diversification of financial centers. Also, that will help create new employment and business opportunities as well as economic growth in Japan.The entry of foreign asset management firms into Japanese markets is important for that purpose. Thus, the Financial Services Agency (“FSA”) and Local Finance Bureaus (“LFBs”) will establish “Financial Market Entry Office” to handle pre-application consultation, registration, and supervision for newly entering asset management firms as a single point of contact with all the communications available in English. To achieve that, the FSA will amend relevant regulations to accept documents in English, and the FSA and LFBs will improve their capacities.

These measures are a part of initiatives (in relation to, for example, taxation, human capital, business environment, and administrative services in English) to promote Japan’s financial market and to attract more foreign financial business operators and professionals to Japan. The FSA and LFBs will pursue the initiatives in this area.

1. Financial Market Entry Office

“Financial Market Entry Office” (the “Office”) will be established in January 2021 by incorporating staff from relevant sections within the FSA and LFBs. The Office will become a single point of contact for newly entering asset management firms for pre-application consultation, registration, and supervision. The communications will be available online in such forms as video conferences without meeting in-person. The Office is expected to accelerate the registration process for newly entering asset management firms by helping them overcome language barriers. At the same time, LFBs that are in charge of the registration process will improve their capacities to review registration applications.Currently, the “Financial Market Entry Consultation Desk” (“Desk”) serves as a contact point for any inquiry on procedures under financial laws in connection with the establishment of a business base in Japan by all types of foreign financial business operators. While the application documents for registration in English under the new regime will be acceptable on and after the effective date of the amended regulations, pre-application consultation is available in English from today onward. Please contact the Desk for that purpose.

Please note that the Office, upon its establishment, will inherit all the functions of the Desk, including details of the pre-application consultation before the effective date.

For details on the registration process for any Financial Instruments Business including Investment Management Business, please refer to “Guidebook for Registration of Investment Management Business and Other Financial Instruments Business”.

2. Amendment to Relevant Regulations to Accept Documents in English

Today, the FSA launched a public consultation on an amendment to the relevant Cabinet Office Order and Ordinance and new regulatory notices (collectively, “proposed amendment”). The proposed amendment will be effective from January 2021 and allow foreign asset management firms and other eligible financial business operators to complete the registration process in English for designated types of business. It will also allow them to prepare documents in English which are required to be submitted to the FSA in the course of the business after the registration under the Financial Instruments and Exchange Act (“FIEA”). The following are the key points.Please note that the information below is based on the proposed amendment and is subject to change in the course of finalization.

(1) Who is eligible for application in English?

Persons/entities who fall into either of the following eligibility categories will become able to submit application documents for registration and other documents in English.

(ⅰ)where the person/entity who is authorized to conduct asset management business or

investment advisory business in a foreign jurisdiction or a relevant company of such an entity is

applying for the registration

(ⅱ)where a person who has worked in the above entity as a senior officer or employee is applying for

the registration (i.e. where he/she is named as a senior officer or an important employee in the

application documents)

(2) What types of business can be applied for?

Application in English is possible for the registration for the following types of business under the FIEA.

(ⅰ)Investment Management Business (Article 28(4) of FIEA)

(ⅱ)Investment Advisory and Agency Business (Article 28(3) of FIEA)

(ⅲ)Type-II Financial Instruments Business relevant to asset management business in either of the

following cases

(a)where selling a beneficial certificate of an investment trust or a fund established by itself

(Article 28(2)(i) of FIEA)

(b)where conducting a so-called Deemed Type-II Financial Instruments Business operated by

Asset Management Company of an Investment Corporation or an operator of Investment

Management Business for Qualified Investors (Article 196(2) of the Act on Investment Trusts

and Investment Corporations and Article 29-5(2) of FIEA)

(3) What types of documents can be submitted in English?

A list of the documents which can be prepared in English can be found here.

(4) Supervision and Inspection in English

The FSA (including Securities and Exchange Surveillance Commission) will promote the use of English in its supervision and inspection with regard to newly registered foreign asset management firms under the new regime. Starting from January 2021, in addition to the documents in the list aforementioned, communications in connection with the supervision and inspection will become available in English too. With a possible increase in the number of registered firms in mind, the FSA will increase the capacities of supervision and inspection accordingly.

(Reference)

| <Updates on January 12, 2021> |

Site Map

- Press Releases & Public RelationsPage list Open

- Press Releases

- Press Conferences

- Official Statements

- FSA Weekly Review & ACCESS FSA

- Speeches

- For Financial Users

- Others

- Archives

- Laws & RegulationsPage list Open

- Name of Laws and Regulations(PDF)

- Recent Changes (Legislation, Ordinances, Guidelines)

- Guidelines

- Financial Instruments and Exchange Act

- Financial Monitoring Policy

- Public Comment

- No-Action Letter System

- Procedures concerning Foreign Account Management Institutions