Japanese![]()

(Provisional Translation)

Updated May 8, 2023

Financial Services Agency

Information on COVID-19 (Novel Coronavirus)

* Update of the English website may take a little time. For the latest information, please refer to our Japanese website.![]()

Click the information you want to know.

! Warning !

It has been seen that calls, email, SMS, SNS, websites, etc. are used as a means of communication by criminals taking advantage of the outbreak of COVID-19.

FSA urges individuals to remain vigilant against unknown calls, email and websites as such to avoid crime related to the COVID-19 pandemic.

"FSA urges vigilance on Crime Taking Advantage of the COVID-19 Pandemic!"

(Japanese version![]() : published September 10, 2020, English version: published December 1, 2020

: published September 10, 2020, English version: published December 1, 2020

[Attention]

Users of the Natural Disaster Guidelines (including the Special Provisions concerning COVID-19) are never required to pay remuneration to registered support experts! HTML・![]() PDF

PDF

Notice on Establishment of FSA Consultation Hotline Related to COVID-19

The FSA has established the Consultation Hotline Related to COVID-19 as outlined below. The purpose of the Hotline is to accept queries regarding to which contact point at financial institutions inquiries about COVID-19 should be directed, or consultations concerning transactions with financial institutions that have been impacted by COVID-19.

The FSA Consultation Hotline Related to COVID-19 is a toll-free line, so feel free to call for a consultation if you have concerns relate to transaction with financial institutions.

For more information, please see the website listed below.

Notice on Establishment of the FSA Consultation Hotline Related to COVID-19 (Novel Coronavirus)![]() (February 28, 2020) (Available in Japanese)

(February 28, 2020) (Available in Japanese)

0120-156811 (Toll-free) (10:00 a.m. to 5:00 p.m., Weekdays)

(Available only in Japanese)

Note: To dial using an IP phone, please call 03-5251-6813.

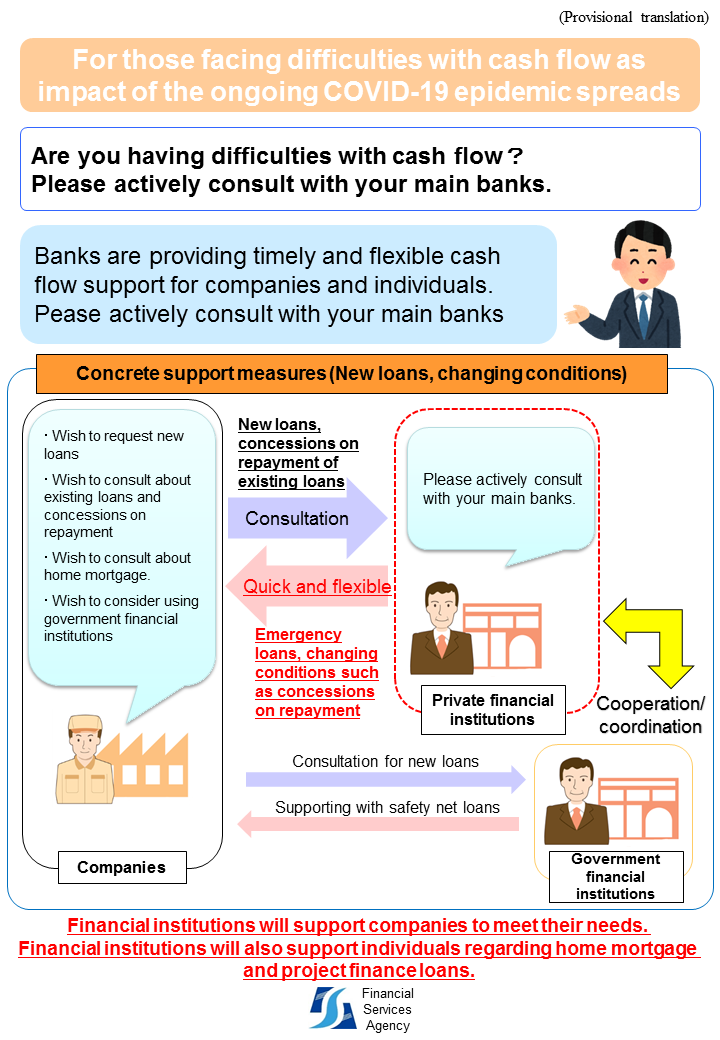

For those facing difficulties with cash flow as impact of the ongoing COVID-19 epidemic spreads

Effectively Interest-free and Unsecured Loans by Private Financial Institutions

the government introduced effectively interest-free and unsecured loans provided via private financial institutions, utilizing local governments’ loan programs for the purpose of helping SMEs continue their businesses.

* Depending on the local governments’ loan programs, interest will be reimbursed to borrowers afterwards.

Effectively Interest-free and Unsecured Loans by Private Financial Institutions ※Application has been closed.

(Japanese version![]() : published May 1, 2020, English version: published May 27, 2020)

: published May 1, 2020, English version: published May 27, 2020)

For those facing difficulties with cash flow (leaflet)

Financial Services Agency (FSA) has made a leaflet for those facing difficulties with cash flow as impact of the ongoing COVID-19 epidemic spreads.

Banks are providing timely and flexible cash flow support for companies and individuals. Please actively consult with your main banks.

”For those facing difficulties with cash flow as impact of the ongoing COVID-19 epidemic spreads”

”For those facing difficulties with cash flow as impact of the ongoing COVID-19 epidemic spreads”

(![]() Japanese version

Japanese version![]() : published April 8, 2020,

: published April 8, 2020, ![]() English version

English version![]() : published April 8, 2020)

: published April 8, 2020)

Notice to call for attention to prevent multiple debts

(Concerning factoring by paying high commission fees)

When a company concludes a factoring contract to procure funds through an assignment of accounts receivable, etc. by paying high commission fees or at high discount rates, there is a risk that the company may face a tighter cash-flow situation and result in owing multiple debts. Please pay great attention to avoid such situation.

Notice to call for attention to prevent multiple debts (Concerning factoring by paying high commission fees)

(Japanese version![]() : published April 28, 2020, English version: published May 27, 2020)

: published April 28, 2020, English version: published May 27, 2020)

Statement by Minister of State for Financial Services, Requests to Financial Institutions (related to cash flow support)

■ Statement by Minister of State for Financial Services

Maintenance of the Functions of the Financial System and Financial Markets under the Declaration of a State of Emergency Responding to the Spread of the COVID-19 Infection

(Japanese version![]() : published April 23, 2021,English version: published May 6, 2021)

: published April 23, 2021,English version: published May 6, 2021)

Maintenance of the Functions of the Financial System and Financial Markets under the Declaration of a State of Emergency Responding to the Spread of the COVID-19 Infection

(Japanese version![]() : published January 7, 2021,English version: published March 1, 2021)

: published January 7, 2021,English version: published March 1, 2021)

Request for Thorough Support for Companies Based on the Comprehensive Economic Measures to Secure People’s Lives and Livelihoods toward Relief and Hope

(Japanese version![]() : published December 8, 2020,English version: published January 28, 2021)

: published December 8, 2020,English version: published January 28, 2021)

Amendment to the “Act on Special Measures for Strengthening Financial Functions”

(Japanese version![]() : published May 27, 2020, English version: published May 27, 2020)

: published May 27, 2020, English version: published May 27, 2020)

Future Cash Flow Support for Companies

(Japanese version![]() : published May 27, 2020, English version: published June 23, 2020)

: published May 27, 2020, English version: published June 23, 2020)

- Other Statement by Minister

-

Future Responses in Consideration of the Declaration of the Cancellation of a State of Emergency in Relation to COVID-19 Infection

(Japanese version

: published May 25, 2020, English version: published June 23, 2020)

: published May 25, 2020, English version: published June 23, 2020)Cash Flow Support for Businesses (Statement by Mr. Aso, Deputy Prime Minister, Minister of Finance and Minister of State for Financial Services, and Mr. Kajiyama, Minister of Economy, Trade and Industry)

(Japanese version

: published April 27, 2020, English version: published May 27, 2020)

: published April 27, 2020, English version: published May 27, 2020)On ensuring sound market function and market fairness

(Japanese version

: published March 24, 2020, English version: published March 24, 2020)

: published March 24, 2020, English version: published March 24, 2020)Maintenance of the Functions of the Financial System and Financial Markets under the Declaration of a State of Emergency Responding to the Spread of the COVID-19 Infection

(Japanese version

: published May 14, 2020, English version: published June 4, 2020)

: published May 14, 2020, English version: published June 4, 2020)Maintenance of the Functions of the Financial System and Financial Markets under the Declaration of a State of Emergency Responding to the Spread of the COVID-19 Infection

(Japanese version

: published May 4, 2020, English version: published May 27, 2020)

: published May 4, 2020, English version: published May 27, 2020)On maintaining the function of the financial system and financial markets under the declaration of a state of emergency responding to the spread of COVID-19

(Japanese version

: published April 16, 2020, English version: published April 17, 2020)

: published April 16, 2020, English version: published April 17, 2020)On maintaining the function of the financial system and financial markets under the declaration of a state of emergency responding to the spread of COVID-19

(Japanese version

: published April 7, 2020, English version: published April 7, 2020)

: published April 7, 2020, English version: published April 7, 2020)On ensuring sound market function and market fairness

(Japanese version

: published March 24, 2020, English version: published March 24, 2020)

: published March 24, 2020, English version: published March 24, 2020)Cash Flow Support for Companies as Impact of COVID-19 (Novel Coronavirus) Outbreak Grows

(

Japanese version

Japanese version : published March 6, 2020,

: published March 6, 2020,  English version

English version : published March 13, 2020)

: published March 13, 2020)

■ Notice on Requests to Financial Institutions (related to cash flow support)

The FSA makes the following requests to financial institutions.

Request for Thorough Support for Companies based on the SME Revitalization Package NEXT

(Japanese version: published September 9, 2022, English version: published March 27, 2023)

- A notice was issued in the joint names of related ministers to public and private financial associations to request cooperation for thorough support for companies based on the SME Revitalization Package NEXT, which was formulated on September 8 for the purpose of further expanding cash flow support in light of changes in the economic environment and accelerating comprehensive measures to support SMEs' initiatives for improving earning power, rehabilitating business, or taking on challenges again.

Request for Thorough Cash Flow Support for Companies Based on the Comprehensive Emergency Measures to Address Soaring Crude Oil and Commodity Prices and Related Matters

(Japanese version: published May 11, 2022, English version: published September 7, 2022)

- Due to the prolonged impact of the COVID-19 infection and other concerns over the recent situation in Ukraine, etc., uncertainties are looming and the effect of soaring crude oil and commodity prices has become a matter of concern. Under such circumstances, a request for thorough cash flow support for companies was issued to public and private financial associations, etc. in the joint names of related ministers based on the Comprehensive Emergency Measures to Address Soaring Crude Oil and Commodity Prices and Related Matters, which was decided on April 26.

Further simplification of certificates to be issued to COVID-19 patients staying at designated facilities or at home (for insurance companies)

(Japanese version: published April 27, 2022, English version: published September 7, 2022)

- On May 15, 2020, the FSA issued a notice to insurance companies to request them to simplify clerical procedures in response to claims for insurance benefits for hospitalization filed by insurance policyholders for their medical care at designated facilities or at home, such as making payments based on certificates in a simplified form. This time, the Ministry of Heath, Labour and Welfare issued an administrative circular on further simplification of certificates.

Facilitation of Fiscal Year-end Finance for Companies and Facilitation of Finance for Companies, etc.

(Japanese version: published March 7 and 8, 2022, English version: published May 9, 2022)

- The Meeting to Exchange Views on the Facilitation of Finance for SMEs was held.

- Due to the prolonged impact of the COVID-19 infection over two years, and other concerns over the situation in Ukraine and further increases in oil prices, etc., various types of companies have been in a tough situation. A notice was issued in the joint names of related ministers to public and private financial associations to request them to make the utmost efforts to respond to companies' demand for operating capital toward the fiscal year end and offer further support to companies based on the "Guidelines for Business Revitalization, etc. of Small- and Medium-sized Enterprises" compiled and published by the Japanese Bankers Association and other related parties.

Additionally, a notice was also issued to the Regional Economy Vitalization Corporation of Japan and the Organization for Small & Medium Enterprises and Regional Innovation as their cooperation is considered to be important in disseminating the Guidelines and encouraging SMEs to make efforts for improving earning power, business revitalization, or taking on new challenges.

Responses to COVID-19 Patients Caring for Themselves at Home Using Kanagawa Prefecture's Self-Caring Notification System (Re. Insurance Companies)

(Japanese version: published February 25, 2022, English version: published March 28, 2022)

[Request for the Protection of Policyholders and Consideration to the Local Government]

- Other publications

-

Request for Thorough Cash Flow Support for Companies toward the End of the Year

(Japanese version: published December 21, 2021, English version: published January 31, 2022)We request the following:

Toward the end of the year, when demand for operating capital increases, financial institutions are further expected to fulfil their intermediary functions so as to prevent any serious hindrance to the financing of companies. We ask financial institutions to endeavor to ensure support friendly to individual customers to the extent possible by proactively and appropriately ascertaining their circumstances, instead of automatically and rigidly making decisions only based on companies' current financial conditions.Meeting to Exchange Views on the Facilitation of Finance for SMEs and Request for Thorough Support for Companies Based on the Economic Measures to Overcome New Coronavirus Infections and to Carve Out a New Era

(Japanese version: published November 24, 2021, English version: published December 15, 2021)We request the following:

・The Meeting to Exchange Views on the Facilitation of Finance for SMEs was held.

・In consideration of the current circumstances in which a number of companies are still facing difficulties due to the impact of the COVID-19 infection, in order to ensure that serious funding difficulties will not arise toward the end of the year or the business year, when demand for operating capital is expected to increase, a request for thorough support for companies was issued in the joint names of related ministers based on the Economic Measures to Overcome New Coronavirus Infections and to Carve Out a New Era, which was formulated at the Cabinet meeting on November 19, 2021.Publication: Treatment for Highly Feasible Fundamental Reconstruction Plan upon Determining if the lending ranks as restructured loan under the Impact of the COVID-19 Infection

(Japanese version: published October 8, 2021, English version: published November 10, 2021)We request the following:

In a released notice to related association representatives issued on September 10, 2021 ("Thorough Cash Flow Support, etc. for Companies According to Individual Circumstances"), the FSA clarified its stance that "financial institutions may take flexible measures when determining if the lending ranks as restructured loan, such as extending a period for a highly feasible fundamental Reconstruction plan, postponing the deadline for formulating a plan, or formulating a plan based on business performances before the outbreak of the COVID-19 infection."

From the perspective of requesting financial institutions to continue their utmost efforts for providing cash flow support closely to companies based on the content of the relevant written notice, the FSA compiled the basic views concerning the flexible measures in the form of Q&As as shown in the Attachment.Thorough Cash Flow Support, etc. for Companies According to Individual Circumstances

(Japanese version: published September 10, 2021, English version: published October 4, 2021)We request the following:

Under the current circumstances where the declaration of a state of emergency was reextended and the impact of the COVID-19 infection is being prolonged, financial institutions are required to continue their utmost efforts to ensure cash flow support meticulously and promptly depending on needs, while positively ascertaining the business conditions, in consideration of the impact of the extended declaration, under which people are requested to refrain from going out unnecessarily, companies are required to suspend business or shorten business hours, and various events are subject to restrictions.Thorough Cash Flow Support, etc. for Companies According to Individual Circumstances

(Japanese version: published June 10, 2021, English version: published July 15, 2021)We request the following:

Due to the further expansion of the impact of the COVID-19 infection, the national government decided to re-extend the declaration. Financial institutions are required to continue their utmost efforts to ensure cash flow support meticulously and promptly, while positively ascertaining the business conditions and funding needs of companies, in consideration of the impact of the extended declaration, under which people are requested to refrain from non-essential outings, companies are required to suspend business or shorten business hours, and various events are subject to restrictions.Cash Flow Support for Companies in Response to the Extension of the Declaration of a State of Emergency

(Japanese version: published May 12, 2021, English version: published June 3, 2021)We request the following:

Due to the further expansion of the impact of the COVID-19 infection, the national government decided to extend the declaration. Financial institutions are required to continue their utmost efforts to ensure cash flow support meticulously and promptly, while positively ascertaining the business conditions and funding needs of companies, in consideration of the impact of the extended declaration, under which people are requested to refrain from non-essential outings, companies are required to suspend business or shorten business hours, and various events are subject to restrictions.Cash Flow Support for Companies in Response to the Declaration of a State of Emergency and Responses Required during the Golden Week Holidays

(Japanese version: published April 28, 2021, English version: published June 3, 2021)We request the following:

Due to the further expansion of the impact of the COVID-19 infection, the national government issued the declaration of a state of emergency again. Financial institutions are requested to fully ascertain companies' business conditions in light of the influence of the declaration and make the utmost efforts to meticulously and promptly offer cash flow support.Cash Flow Support for Companies Including Those Providing Accommodation and Eating and Drinking Services, etc. (Request)

(Japanese version: published March 25, 2021, English version: published May 25, 2021)We request the following:

Businesses providing accommodation and eating and drinking services, in particular, have been seriously affected by the restriction of economic activities. The national government has compiled emergency financial support packages to assist business owners with their efforts to continue or reconstruct their businesses while meticulously responding to their needs, and requests financial institutions to provide cash flow support based thereon positively to companies, including those providing accommodation and eating and drinking services.Bridge Loans Until the Payment of Cooperation Money, etc. to Dining and Drinking Establishments

(Japanese version: published April 16, 2021, English version: published May 24, 2021)We request the following:

Requested cooperation in providing prompt and active cash flow support in accordance with the circumstances and needs of respective businesses, including the provision of bridge loans for funds that are necessary until the cooperation money to Dining and Drinking Establishments and other benefits are actually paid.Facilitation of Fiscal Year-end Finance for Companies

(Japanese version: published March 8, 2021, English version: published April 23, 2021)We request the following:

In consideration of the prolongation of the impact of the COVID-19 infection into the second business year and in light of an expected continuation of influence exerted on companies by restriction of economic activities and other policies, the FSA held a meeting to exchange views on the facilitation of finance for companies including SMEs between government officials and representatives of financial institutions and issued a request for cooperation for the facilitation of fiscal year-end finance for companies.Cash Flow Support for Companies in Consideration of the Extension of the Declaration of a State of Emergency

(Japanese version: published March 4, 2021, English version: published April 22, 2021)We request the following:

The FSA requested groups of major banks, etc. not only to positively provide cash flow support to SMEs but to also check the funding needs of large companies and leading medium-sized companies, meticulously respond to consultations from companies, kindly and empathically offer services irrespective of trade statuses, verify measures to prevent abuse of dominant bargaining positions by banks, and occasionally inspect whether friendly services are being provided to companies at sales bases.Cash Flow Support for Companies in Consideration of the Extension of the Declaration of a State of Emergency

(Japanese version: published February 5, 2021, English version: published April 20, 2021)We request the following:

Due to the further expansion of the impact of the COVID-19 infection, the national government decided to extend the declaration. Financial institutions are required to continue their utmost efforts to ensure cash flow support towards the fiscal year end in consideration of such impact of the infection and the business conditions and funding needs of SMEs and leading medium-sized companies.Cash Flow Support for Companies in Response to the Expansion of the Impact of the COVID-19 Infection

(Japanese version: published January 19, 2021, English version: published February 25, 2021)We request the following:

Due to the further expansion of the impact of the COVID-19 infection, the national government declared a state of emergency. In consideration of the influence of the declaration, the FSA requests financial institutions to continue making their utmost efforts to meticulously and promptly provide cash flow support to companies while sufficiently ascertaining their business conditions.Cash Flow Support for Companies in Response to Measures to Prevent the Spread of Infection toward Year-end and New-year Holidays

(Japanese version: published December 18, 2020, English version: published February 25, 2021)We request the following:

From the perspective of taking the greatest possible measures to prevent any further spread of infection toward the year-end and new-year holidays, the national government has decided to suspend the Go To travel campaign. Therefore, financial institutions etc. are requested to make further efforts to secure cash flow support.

Request for Thorough Support for Companies Based on the Comprehensive Economic Measures to Secure People’s Lives and Livelihoods toward Relief and Hope

(Japanese version: published December 8, 2020, English version: published January 28, 2021)We request the following:

- Requested to combine various means, such as deferment of payments or alteration of other loan conditions, proper loans, and loans guaranteed by Credit Guarantee Corporations, thereby offering support in accordance with companies' needs, towards the end of the year or the business year.

- Requested to offer support for management improvement and business reconstruction and transformation to companies that face challenges not limited to funding difficulties amid the prolonged COVID-19 pandemic while utilizing funds contributed by the Regional Economy Vitalization Corporation of Japan, etc. and subordinated loans recognizable as capital provided by the Japan Finance Corporation, etc.

- Requested to closely collaborate with local governments, Credit Guarantee Corporations, government financial institutions, as well as with the SME Revitalization Support Committee, certified public tax accountants and other relevant local organizations, upon offering support for companies.

Facilitation of Year-end Finance for SMEs and Small Businesses

(Japanese version: published November 30, 2020, English version: published January 21, 2021)We request the following:

- In consideration of the current circumstances in which there still are businesses that are facing serious funding difficulties due to the impact of the COVID-19 infection and in light of an expected increase in demand for operating capital toward the end of the year or the business year, the FSA held a meeting to exchange views on the facilitation of finance for SMEs, etc. between government officials and representatives of financial institutions, and issued a request for cooperation for the facilitation of year-end finance for SMEs and small businesses to the following financial associations.

Cash Flow Support for Companies in Consideration of the Impact of Suspension of Events, etc.

(Japanese version: published December 17, 2020, English version: published January 15, 2021)We request the following:

-

Requested to meticulously provide consultation, make loans appropriately on a timely basis, flexibly secure collateral, and alter loan conditions including deferment of payments so that SMEs and small businesses will not face funding difficulties affected by the suspension or postponement of events and resulting refunds due to the current spread of the COVID-19 infection.

Cash Flow Support for Companies in Consideration of the Spread and Prolongation of the Impact of COVID-19 (Novel Coronavirus) Outbreak (Request)

(Japanese version: published June 10, 2020, English version: published June 23, 2020)We request the following:

-

Companies to which you have already provided loans may make consultations on new loans due to the prolonged impact of COVID-19 infection. Please deal with such consultations with respect based on the supplementary budget, which expanded countermeasures against the pandemic.

-

Endeavor to offer support promptly and positively depending on the circumstances of respective companies, including loans for funds that become necessary until the payment of various benefits such as subsidies for sustaining businesses, rent assistance subsidy, and employment adjustment subsidy.

-

As we have repeatedly requested, government financial institutions, in particular, are requested to give maximum consideration in loan screening depending on the circumstances of respective companies, instead of making judgments formalistically based only on such data as whether they have deficits or excessive debts or their loan terms have already been modified.

Request concerning home loans, etc.

(Japanese version: published May 27, 2020, English version: published June 23, 2020)-

At a public meeting with business organizations, the FSA requested prompt and flexible responses to modification of conditions of home loans, etc.

Cash Flow Support for Companies under the Second Supplementary Budget for FY2020 (Request)

(Japanese version: published May 27, 2020, English version: published June 23, 2020)【Request concerning cash flow support for companies】

From the perspective of making utmost efforts for further securing prompt and proper support measures for companies, such as the deferment of principal payments or alteration of other loan conditions and the provision of new loans, depending on the circumstances of respective companies, the FSA publicizes the following matters to note.-

The FSA respects financial institutions' decisions to maintain previous evaluations regarding customers that they had recognized as being financially sound before the spread of COVID-19 infection.

-

We will analyze the balances of private financial institutions' proper loans and conduct hearings concerning the status of their cash flow support for companies, such as whether loan balances are decreasing or not, while referring to loans and guarantees provided by government financial institutions, etc.

-

Active use of borrowings recognizable as capital is recommendable and we will clearly indicate this in the Guidelines for Supervision.

Cash Flow Support for Businesses regarding Rent (Request)

(Japanese version: published May 8, 2020, English version: published May 27, 2020)【Request for cash flow support regarding rent】

-

For SMEs and individuals facing difficulties in paying rent, promptly and flexibly provide new loans or bridge loans using the newly introduced substantially no-interest and unsecured loan system or other loan programs, or modify terms for existing loans such as granting reduction or deferment of payments on principal and interests.

-

For owners of hotels, leisure facilities, and commercial buildings, promptly and flexibly provide new loans or bridge loans, or alter conditions for existing loans such as granting reduction or deferment of payments on principal and interests.

In particular, when owners are granting tenants reduction or deferment on payments of rent for a certain period of time, financial institutions are urged to take prompt and flexible measures for the relevant period of time, granting reduction or deferment on payments of loans. -

With regard to fees and penalty charges that are normally required upon modification of terms for existing loans, give special consideration in light of each customer's circumstances.

Cash Flow Support for Businesses following the “Emergency Economic Measures to cope with COVID-19” (Request to financial institutions)

(Japanese version: published April 27, 2020, English version: published May 27, 2020)【Request regarding support for companies】

-

Exhaustively offer cash flow support by providing funds under the substantially no-interest and unsecured loan system promptly and properly.

-

On that occasion, promote one-stop procedures to integrate and accelerate various procedures for providing loans by the use of local governments' loan programs, in consideration of companies' convenience.

-

Depending on the circumstances of individual companies in urgent need of funds, positively provide bridge loans for funds that are necessary until financial institutions' loans, such as those by the use of local governments' loan programs, are provided or various benefits are actually paid.

-

Open branches as necessary and develop a system to respond to consultations from companies also during the Golden Week holidays from May 2 to 6.

Cash Flow Support for Companies in Consideration of the Novel Coronavirus Disease (COVID-19) Emergency Economic Measures (Request)

(Japanese version: published April 7, 2020, English version: published April 16, 2020)

【Request pertaining to support for companies and individuals】- "System to Enable Companies to Obtain Substantially Interest-Free and Unsecured Loans from Private Financial Institutions by the Use of Local Governments' Loan Programs"

- Do not treat all cases automatically and formalistically, where companies fall foul of financial covenants.

- Regarding home loans and loans for individuals, make prompt and flexible responses in changing loan conditions while fully taking into account individual customers' needs, based on past requests from the FSA.

Cash Flow Support for Companies as Impact of COVID-19 (Novel Coronavirus) Outbreak Grows

(Japanese version: published March 6, 2020, English version: published April 6, 2020)【Request related to support for companies】

The Minister requested:- Determine the business conditions and short-term cash flow at companies in even greater detail by visiting their facilities, setting up emergency consultation desks, etc.

- Follow up carefully on circumstances at companies that have existing loans and be quick and flexible in changing loan conditions

- Actively implement emergency lending programs for new loans (and make collateral/guarantee requirements more flexible) to meet the needs of companies promptly and appropriately, including the use of safety net loans/guarantees from policy financial institutions and credit guarantee associations

- Establish systems capable of providing prompt and appropriate support for companies.

Notice regarding the form of the certificates to be issued to COVID-19 patients with mild or no symptoms staying at designated facilities or at home (request)

(

Japanese version

Japanese version : published May 19, 2020,

: published May 19, 2020,  English version

English version : published June 4, 2020)【Request for policyholder protection and taking into account the circumstances of respective local governments】With regard to certificates required for the payment of insurance benefits for hospitalization in relation to the COVID-19 infection, the FSA requested insurance companies to take flexible measures, while taking into account the circumstances faced by respective local governments.

: published June 4, 2020)【Request for policyholder protection and taking into account the circumstances of respective local governments】With regard to certificates required for the payment of insurance benefits for hospitalization in relation to the COVID-19 infection, the FSA requested insurance companies to take flexible measures, while taking into account the circumstances faced by respective local governments.Consideration by Association Members in Making Payments to Affiliated Stores amid the COVID-19 Pandemic (Request)

(

Japanese version

Japanese version : published May 11, 2020,

: published May 11, 2020,  English version

English version : published May 27, 2020)【Request to cashless payment service providers regarding payments to affiliated stores】The FSA issued the following request to the Japan Payment Service Association with regard to consideration to be given by its members in making payments to affiliated stores amid the COVID-19 pandemic.Cashless payment service providers are requested to meticulously and empathically respond to consultations from affiliated stores affected by the COVID-19 infection with regard to the timing of reimbursement of advance payments and expenses for reimbursement, etc., and endeavor to take flexible and appropriate measures, such as the alteration of the timing.

: published May 27, 2020)【Request to cashless payment service providers regarding payments to affiliated stores】The FSA issued the following request to the Japan Payment Service Association with regard to consideration to be given by its members in making payments to affiliated stores amid the COVID-19 pandemic.Cashless payment service providers are requested to meticulously and empathically respond to consultations from affiliated stores affected by the COVID-19 infection with regard to the timing of reimbursement of advance payments and expenses for reimbursement, etc., and endeavor to take flexible and appropriate measures, such as the alteration of the timing.Consideration to Companies in Relation to the Payment of Rent (Request)

(

Japanese version

Japanese version : published May 8, 2020,

: published May 8, 2020,  English version

English version : published May 27, 2020)【Request for consideration to companies in relation to the payment of rent】The FSA issued the following request to investment management business operators with regard to consideration to companies in relation to the payment of rent.For tenants who are counterparties to lease contracts with relevant investment corporations, etc. and are facing difficulties in paying rent, consider flexible measures, such as granting reduction or exception of or moratoriums on payments of rent, while fulfilling accountability to investors as necessary.

: published May 27, 2020)【Request for consideration to companies in relation to the payment of rent】The FSA issued the following request to investment management business operators with regard to consideration to companies in relation to the payment of rent.For tenants who are counterparties to lease contracts with relevant investment corporations, etc. and are facing difficulties in paying rent, consider flexible measures, such as granting reduction or exception of or moratoriums on payments of rent, while fulfilling accountability to investors as necessary.Further Strengthening of Cooperation with the Japan Finance Corporation, etc. (Request)

(

Japanese version

Japanese version : published April 21, 2020,

: published April 21, 2020,  English version

English version : published May 19, 2020)【Request for further strengthening cooperation with the Japan Finance Corporation, etc.】The FSA made the following request for further strengthening cooperation with the Japan Finance Corporation, etc. to the Japanese Bankers Association, the Regional Banks Association of Japan, The Second Association of Regional Banks, The National Association of Shinkin Banks, and the Community Bank Shinyo Kumiai.With regard to loans provided by private financial institutions as bridge loans until loans are provided by the Japan Finance Corporation, etc., when requests for refunding by the Japan Finance Corporation, etc. are filed both by companies and relevant private financial institutions, the Japan Finance Corporation, etc. will accept such requests to the extent possible. Based on this policy, private financial institutions are requested to proactively provide bridge loans or otherwise offer cash flow support for companies.In order to facilitate the aforementioned efforts for cash flow support, private financial institutions are requested to closely cooperate with branches of the Japan Finance Corporation, etc. in respective areas in executing loans, while referring to past cooperative efforts between the Japan Finance Corporation, etc. and private financial institutions.

: published May 19, 2020)【Request for further strengthening cooperation with the Japan Finance Corporation, etc.】The FSA made the following request for further strengthening cooperation with the Japan Finance Corporation, etc. to the Japanese Bankers Association, the Regional Banks Association of Japan, The Second Association of Regional Banks, The National Association of Shinkin Banks, and the Community Bank Shinyo Kumiai.With regard to loans provided by private financial institutions as bridge loans until loans are provided by the Japan Finance Corporation, etc., when requests for refunding by the Japan Finance Corporation, etc. are filed both by companies and relevant private financial institutions, the Japan Finance Corporation, etc. will accept such requests to the extent possible. Based on this policy, private financial institutions are requested to proactively provide bridge loans or otherwise offer cash flow support for companies.In order to facilitate the aforementioned efforts for cash flow support, private financial institutions are requested to closely cooperate with branches of the Japan Finance Corporation, etc. in respective areas in executing loans, while referring to past cooperative efforts between the Japan Finance Corporation, etc. and private financial institutions.Notice regarding the handling of bills and checks, etc. in consideration of the impact of the COVID-19 (novel coronavirus) infection

(

Japanese version

Japanese version : published April 16, 2020,

: published April 16, 2020,  English version

English version : published April 23, 2020)

: published April 23, 2020)Application of Policy Conditions in Relation to COVID-19 Infection (request to insurance companies)

(

Japanese version

Japanese version : published April 10, 2020,

: published April 10, 2020,  English version

English version : published April 23, 2020)【Request related to protecting policyholders】Insurance companies should take measures to avoid possible confusion in each situation in advance and are requested to consider flexible interpretation and application of policy conditions, and to devise required measures for each policy plan in terms of protecting policyholders without adhering to precedents.

: published April 23, 2020)【Request related to protecting policyholders】Insurance companies should take measures to avoid possible confusion in each situation in advance and are requested to consider flexible interpretation and application of policy conditions, and to devise required measures for each policy plan in terms of protecting policyholders without adhering to precedents.Cash Flow Support for Companies as Impact of COVID-19 (Novel Coronavirus) Outbreak Grows (Request)

(

Japanese version

Japanese version : published March 24, 2020,

: published March 24, 2020,  English version

English version : published April 6, 2020)【Request related to support for companies】To endeavor to strengthen cooperation with the Japan Finance Corporation, etc., in order to make every effort in financing support for companies.For companies who have carried out a change in conditions concerning existing loans, to sincerely and conscientiously respond to continuing financing support even after the change in conditions as well as consultations for management improvements.To actively cooperate with credit guarantee corporations, and make practical use of the safety net guarantee system and other systems based on additional requests of the Small and Medium Enterprise Agency.

: published April 6, 2020)【Request related to support for companies】To endeavor to strengthen cooperation with the Japan Finance Corporation, etc., in order to make every effort in financing support for companies.For companies who have carried out a change in conditions concerning existing loans, to sincerely and conscientiously respond to continuing financing support even after the change in conditions as well as consultations for management improvements.To actively cooperate with credit guarantee corporations, and make practical use of the safety net guarantee system and other systems based on additional requests of the Small and Medium Enterprise Agency.Request to insurance companies to take measures in response to the COVID-19 (novel coronavirus) infection

(Japanese version

: published March 13, 2020,

: published March 13, 2020,  English version

English version : published March 27, 2020)【Request for policyholder protection】Take the following three actions:Implementing appropriate measures, such as having flexibility in extending a grace period for payment of premiums and policy renewal;Communicating the measures mentioned above to stakeholders as many stakeholders, including to insurance policyholders as possible; andIf insurers close providing over-the-counter services and/or take other emergency measures due to the spread of infections, promptly announcing to the public and customers information on such measures, including names of branches or offices.

: published March 27, 2020)【Request for policyholder protection】Take the following three actions:Implementing appropriate measures, such as having flexibility in extending a grace period for payment of premiums and policy renewal;Communicating the measures mentioned above to stakeholders as many stakeholders, including to insurance policyholders as possible; andIf insurers close providing over-the-counter services and/or take other emergency measures due to the spread of infections, promptly announcing to the public and customers information on such measures, including names of branches or offices.Request for the Implementation of Measures against COVID-19 (Novel Coronavirus) Outbreak

【Requests related to support for business operators】Where a business operators is impacted by the disease, we request that financial institutions provide polite management consultations, such as visiting the business operator, supply the funds necessary for business continuation, and respond appropriately to modify conditions with existing loans.

Concrete Measures Taken by Financial Institutions in Response to the COVID-19 Infection

The FSA has requested financial institutions to make utmost efforts in response to the COVID-19 infection, in accordance with the situations of respective companies, such as the alteration of loan conditions and provision of new loans, and has confirmed the implementation status through special hearings or other means, while assigning top priority to promoting cash flow support for companies in conducting inspection and supervision.

Out of confirmed concrete measures, the FSA will compile and publicize those that are helpful for other financial institutions, as needed.

"Concrete Measures Taken by Financial Institutions in Response to the COVID-19 Infection"

(![]() Japanese version

Japanese version![]() : updated May 22, 2020,

: updated May 22, 2020, ![]() English version

English version![]() : updated June 23, 2020)

: updated June 23, 2020)

(Reference) Underlined version of the latest update cases

(![]() Japanese version

Japanese version![]() : updated May 22, 2020,

: updated May 22, 2020, ![]() English version

English version![]() : updated June 23, 2020)

: updated June 23, 2020)

Corporate disclosure, financial reporting and audit, etc.

■ The deadline for submission of annual securities and other reports

The following is a notification regarding the deadline for submission of annual securities and other reports in connection with the COVID-19 infection. If you have any questions, please do not hesitate to contact your local Finance Bureau or its branch office.

- Publications

-

"Notice regarding the deadline for submission of annual securities and other reports in connection with COVID-19 infection"

(Japanese version : published April 26, 2021, English version: published May 12, 2021)

: published April 26, 2021, English version: published May 12, 2021)

"Notice regarding the deadline for submission of annual securities and other reports in connection with COVID-19 infection"

(Japanese version : published January 8, 2021, English version: published February 25, 2021)

: published January 8, 2021, English version: published February 25, 2021)

"Notice regarding the deadline for submission of annual securities and other reports in connection with COVID-19 infection"

(Japanese version : published February 10, 2020, English version: published March 13, 2020)

: published February 10, 2020, English version: published March 13, 2020)

■ The corporate disclosure, financial reporting and audit

The networking group is established to support stakeholders' further engagement and have a proper information sharing on the corporate disclosure, financial reporting and audit, in light of the current uncertainty resulting from the COVID-19 outbreak.

- Publications

-

"Establishment of the Networking Group on the corporate disclosure, financial reporting and audit of listed companies in Consideration of the Impact of the COVID-19 (Novel Coronavirus) Infection"

(Japanese version : published April 3, 2020, English version: published April 16, 2020)

: published April 3, 2020, English version: published April 16, 2020)Corporate Year-End Closing of Accounts, Auditing and Shareholders meeting in Response to the Increasing Impact of COVID-19 (Novel Coronavirus)

(Japanese version : published April 15, 2020, English version: published April 15, 2020)

: published April 15, 2020, English version: published April 15, 2020)Our Responses to Financial reporting and audit of listed companies in consideration to the Impact of the COVID-19 Infection (Main Points)

( Japanese version

Japanese version : published July 2, 2020,

: published July 2, 2020,  English version

English version : published August 26, 2020)

: published August 26, 2020)

■ Notice Regarding the Disclosure of Corporate Information Concerning the Impact of the COVID-19 Infection

Based on the Summary of the Discussions publicized by the Accounting Standards Board of Japan, "Incorporating the Effects of the Novel Coronavirus Pandemic when Making Accounting Estimates under Japanese GAAP" (publicized on April 10 and supplemented on May 11, 2020), the FSA publicized the "Notice Regarding the Disclosure of Corporate Information Concerning the Impact of the COVID-19 Infection."

- Publications

-

Notice Regarding the Disclosure of Corporate Information Concerning the Impact of the COVID-19 Infection in Quarterly Securities Reports

(Japanese version : published July 1, 2020,

: published July 1, 2020,  English version

English version : published July 30, 2020)

: published July 30, 2020)Publication of "Q&A on the Disclosure of Narrative Information Regarding the Impact of COVID-19 Infection – Key Points for Better Disclosure for Investors –"

(Japanese version : published May 29, 2020, English version: published July 9, 2020)

: published May 29, 2020, English version: published July 9, 2020)

Notice Regarding the Disclosure of Corporate Information Concerning the Impact of the COVID-19 Infection

( Japanese version

Japanese version : published May 21, 2020,

: published May 21, 2020,  English version

English version : published June 4, 2020)

: published June 4, 2020)

■ Deadlines for reporting, accounting, and audit work by financial institutions, etc. in consideration of the Impact of the COVID-19 Infection

The FSA publicized new deadlines for reports to be submitted by financial institutions, etc. in consideration of the impact of the COVID-19 infection, and issued an administrative circular concerning companies' accounting and audit work.

- Publications

-

Deadline of supervisory reports from financial institutions, etc. in consideration of the impact of the COVID-19 (novel coronavirus) infection

(Japanese version : published January 8, 2021, English version: published February 25, 2021)

: published January 8, 2021, English version: published February 25, 2021)

Notice regarding accounting and audit work in consideration of the impact of the COVID-19 (novel coronavirus) infection (administrative circular)

( Japanese version

Japanese version : published April 24, 2020,

: published April 24, 2020,  English version

English version : published May 27, 2020)

: published May 27, 2020)Deadline of supervisory reports from financial institutions, etc. in consideration of the impact of the COVID-19 (novel coronavirus) infection

(Japanese version : published March 30, 2020, English version: published April 16, 2020)

: published March 30, 2020, English version: published April 16, 2020)

International Coordination

The Financial Services Agency (FSA) exchanges information on regulatory and supervisory responses to the impact of COVID-19 with international organizations and foreign authorities. FSA also contributes to discussions on policy responses at international organizations including Standard Setting Bodies (SSBs), and coordinates with other authorities.

The following is the list of links to the information published by international organizations including SSBs.

- Publications

-

○ Financial Stability Board(FSB)

○ Basel Committee on Banking Supervision(BCBS)

○ International Organization of Securities Commissions(IOSCO)

○ International Association of Insurance Supervisors(IAIS)

○ Financial Action Task Force(FATF)

Responses other than the above-mentioned

Notice on Requests to Financial Institutions (excepted for cash flow support)

Emergency Responses Concerning Applications and Notifications to be Filed with the FSA in Consideration of the Impact of COVID-19 Infection (repeated information dissemination)

(Japanese version: published February 15, 2022, English version: published March 22, 2022)

Request for Cooperation upon Providing Special Emergency Small Loans, etc. for Individuals

(Japanese version: published December 21, 2021, English version: published January 31, 2022)

- Other publications

-

-

Request for Cooperation upon Providing Self-support Aid for Households Facing Difficulties due to the COVID-19 Infection

(Japanese version: published Decemver 21, 2021, English version: published January 31, 2022) -

Request for Cooperation upon Providing Student Emergency Aid for Continuance of Studies

(Japanese version: published Decemver 21, 2021, English version: published January 31, 2022) -

Request for Cooperation upon Commencement of Acceptance of Applications for Monthly Support Money

(Japanese version: published June 15, 2021, English version: published July 15, 2021) -

Emergency Responses Concerning Applications and Notifications to be Filed with the FSA in Consideration of the Impact of COVID-19 Infection (information dissemination)

(Japanese version: published June 1, 2021, English version: published July 2, 2021) -

Request upon Provision of Temporary Support Grant

( Japanese version

Japanese version : published March 8, 2021, English version: published June 3, 2021)

: published March 8, 2021, English version: published June 3, 2021) -

Publication of the Special Provisions for the Application of the Guidelines for Debt Consolidation after a Natural Disaster to the COVID-19 Infection

(Japanese version : published October 30, 2020, English version: published December 1, 2020)

: published October 30, 2020, English version: published December 1, 2020) -

Temporary Responses Concerning Applications and Notifications to be Filed with the FSA in Consideration of the Impact of COVID-19 Infection (information dissemination)

(Japanese version : published July 17, 2020,

: published July 17, 2020,  English version

English version : published July 30, 2020)

: published July 30, 2020) -

Requests upon Granting of Emergency Student Support Handout for Continuing Studies

( Japanese version

Japanese version : published June 8, 2020,

: published June 8, 2020,  English version

English version : published June 23, 2020)

: published June 23, 2020) -

Request Upon Provision of Subsidies for Sustaining Businesses

( Japanese version

Japanese version : published May 7, 2020,

: published May 7, 2020,  English version

English version : published May 27, 2020)

: published May 27, 2020) -

Notice to call for cooperation for smooth execution of the Special Fixed-Sum Cash Benefit Program (provisional title)

( Japanese version

Japanese version : published April 23, 2020,

: published April 23, 2020,  English version

English version : published May 27, 2020)

: published May 27, 2020) -

Notice regarding the request for reducing attendance at work by 70% (information dissemination)

( Japanese version

Japanese version : published April 13, 2020,

: published April 13, 2020,  English version

English version : published April 23, 2020)

: published April 23, 2020) -

Matters to Note to Prevent Infection in Customer Services

( Japanese version

Japanese version : published April 10, 2020,

: published April 10, 2020,  English version

English version : published April 23, 2020)

: published April 23, 2020) -

Important points concerning BCP suitability based on “Basic policy for Novel Coronavirus (COVID-19) Control”

( Japanese version

Japanese version : published March 30, 2020,

: published March 30, 2020,  English version

English version : published April 16, 2020)

: published April 16, 2020) -

Notice on “Basic policy on COVID-19 (Novel Coronavirus) infection control measures”

(February 25, 2020) (Available in Japanese)

(February 25, 2020) (Available in Japanese) -

Notice on response to measures to prevent the spread of COVID-19 (Novel Coronavirus) infection within Japan

(February 19, 2020) (Available in Japanese)

(February 19, 2020) (Available in Japanese)

-

FSA-Related

- Publications

-

(Japanese version

: published May 22, 2020, English version: published June 4, 2020)

: published May 22, 2020, English version: published June 4, 2020)- Measures of Financial Institutions, etc. for Working from Home

- Notice Regarding the Order Partially Amending the Regulation for Enforcement of the Labor Bank Act, the Order Partially Amending the Order for Credit Business of Agricultural Cooperatives and Federation of Agricultural Cooperatives, etc. and the Order Partially Amending the Regulation for Enforcement of the Shoko Chukin Bank, Ltd. Act Relating to the Ministry of Economy, Trade and Industry, Ministry of Finance, and the Cabinet Office

-

Notice Regarding the Cabinet Order Specifying the Day Specified by Cabinet Order Referred to in Article 2, Paragraph (4) of the Supplementary Provisions of the Act Partially Amending the Banking Act, etc. and the Cabinet Office Order Partially Amending the Regulation for Enforcement of the Banking Act, etc.

(Japanese version : published April 30, 2020, English version: published June 4, 2020)

: published April 30, 2020, English version: published June 4, 2020) -

Notice regarding the request for consideration for maintaining employment as responses to the COVID-19 Infection

( Japanese version

Japanese version : published April 17, 2020,

: published April 17, 2020,  English version

English version : published May 19, 2020)

: published May 19, 2020) -

Notice regarding the conclusion of contracts between banks and electronic payment service providers in consideration of the impact of the COVID-19 (novel coronavirus) infection

(Japanese version : published April 14, 2020, English version: published April 23, 2020)

: published April 14, 2020, English version: published April 23, 2020) -

Notice and Request for Visitors

(Japanese version: published April 7, 2020, English version: published April 16, 2020) -

Implementation timeline for capital adequacy requirements, etc. in Japan

(Japanese version : published March 30, 2020, English version: published April 16, 2020)

: published March 30, 2020, English version: published April 16, 2020) -

Reconfirmation of Prudential Standards in Response to the Increasing Impact of the Spread of COVID-19 (Novel Coronavirus)

(Japanese version : published March 17, 2020,

: published March 17, 2020,  English version

English version : published April 6, 2020)

: published April 6, 2020) -

Cabinet Office Ordinance Concerning Partial Revision of Regulation for Enforcement of the Money Lending Business Act

(Japanese version : published March 16, 2020, English version: published April 6, 2020)

: published March 16, 2020, English version: published April 6, 2020)

Stock Exchange-Related (Available in Japanese)

Site Map

- Press Releases & Public RelationsPage list Open

- Press Releases

- Press Conferences

- Official Statements

- FSA Weekly Review & ACCESS FSA

- Speeches

- For Financial Users

- Others

- Archives

- Laws & RegulationsPage list Open

- Name of Laws and Regulations(PDF)

- Recent Changes (Legislation, Ordinances, Guidelines)

- Guidelines

- Financial Instruments and Exchange Act

- Financial Monitoring Policy

- Public Comment

- No-Action Letter System

- Procedures concerning Foreign Account Management Institutions